Gaining full operational control of Hulu was the missing piece in Disney’s streaming strategy, according to a report by Ampere Analysis. Control of Hulu will allow Disney to reinvent the TV ‘channel family’ for the streaming generation and give it the content scale and bundling flexibility it needs to take the fight to Netflix and Amazon.

Size really does matter

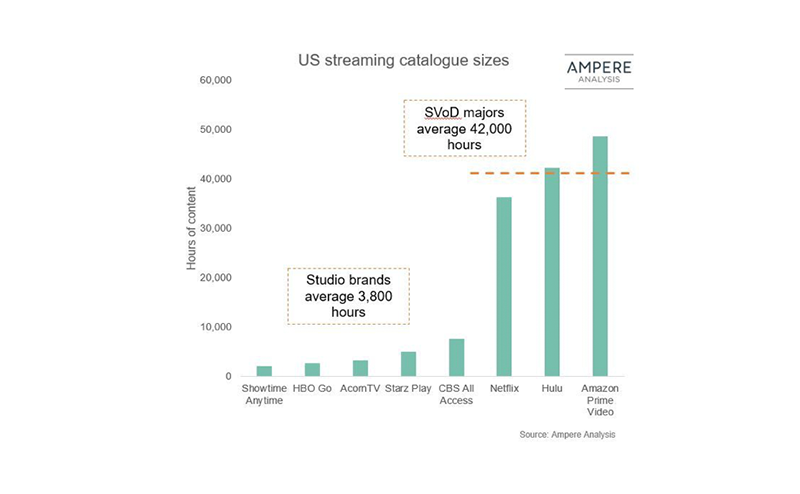

Netflix, Hulu and Amazon have built up impressive content catalogues that to date have represented a significant barrier to entry for new players in the streaming TV space. The three US SVoD ‘majors’ (Netflix, Hulu, Amazon) average 42,000 hours of content. This compares to just 3,800 hours for the streaming studio brands like Showtime, HBO Go and CBS All Access today.

Clawing back content

The major US studios currently license an average of 11,800 of content each to third-party SVoD players. As the studios start to go direct, much of this content is likely to be pulled back to service the studio branded direct-to-consumer streaming services. But even pulling all Disney and Fox third-party streaming content off other SVOD services leaves Disney some way to go to catch Netflix and Amazon in terms of breadth and volume of content.

Hulu is the turbo boost Disney needs

Hulu gives the Disney/Fox streaming alignment the scale it needs, rocketing its content offer past Netflix and Amazon. Crucially it also gives Disney the flexibility to build a true ‘channel family’ for the streaming generation.

Keeping it in the family

Much focus has been given to Disney’s planned price point of $6.99 for its Disney+ service and the fact that it undercuts rival Netflix. But the real opportunity for Disney lies in creating a bundle of streaming channels, in which Hulu will act as a lynchpin. Layering in ESPN for sports fans will be the icing on the cake. The key to building a streaming channel family is the flexibility it gives Disney is bundling services and, crucially, boosting the average revenue it makes from each customer (ARPU). Not every customer will want Disney+ and Hulu, or even ESPN, but with flexible combinations, three streaming brands will mean the $6.99 Disney+ price point is just the beginning in leveraging the revenue potential of its streaming portfolio.

Guy Bisson, research director at Ampere Analysis, said: “With full operational control of Hulu, Disney’s streaming jigsaw puzzle is complete. The concept of building a family of services to capture audience in a fragmented and competitive world is not new—it was first explored when digital TV came along in the early 1990s—Disney now needs to update that model for the 21st Century and Hulu is the key to doing that.”